In 2024, the landscape of strategic outsourcing will continue to evolve, reflecting a shift in business practices and priorities. Initially, companies found comfort in outsourcing low-skill jobs situated in less critical areas of their operations. However, as the outsourcing paradigm matured, businesses have become increasingly willing to delegate more crucial responsibilities, such as managing finances and handling customer service, to external entities. Payroll tasks are among the many other tasks that are now included in this that were previously handled by administrators or human resources departments.

But today, the tables have turned.

5 Benefits of Outsourcing Payroll Services

Hiring a seasoned payroll provider to collaborate with your staff can greatly help your company’s output.

Here are 5 advantages of outsourcing payroll services:

- Time-Saving

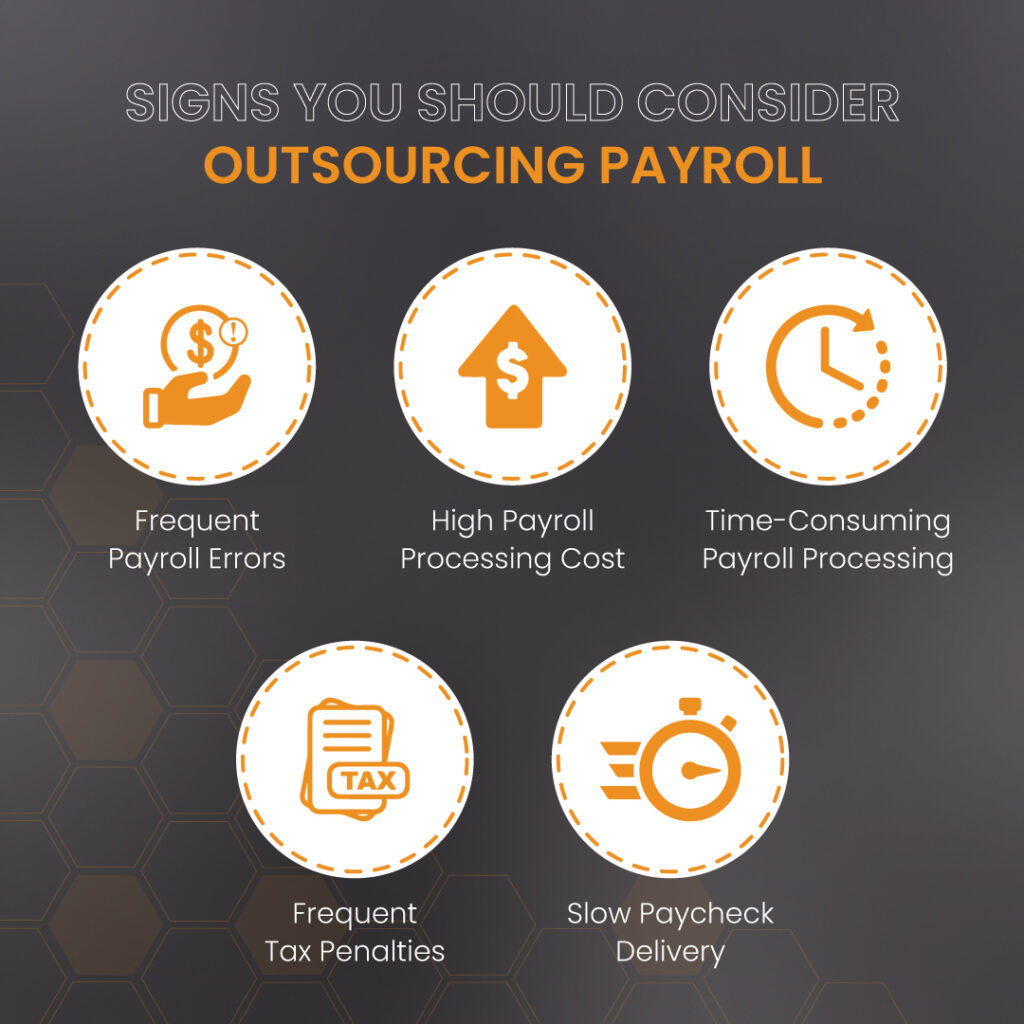

The payroll management system is not an easy task. The payroll department monitors several complex and minute details, including benefit deductions, garnishments, new hires, and terminations, to mention a few. Furthermore, it becomes even more complex with any modifications to state and federal regulations.

Handling payroll internally can be very demanding, and companies that do so annually lose valuable worker hours to W2 preparation. By contracting with a reputable company to handle payroll accounting, you can stop worrying about these tasks.

One of the factors that gives businesses a competitive edge and makes them prefer to outsource payroll accounting is strategic resource management merely because paying employees is a continuous process. There are never enough working hours between one payroll period and the next.

- Prevent Penalties from the Internal Revenue Service (IRS)

Many small and large businesses have to pay significant IRS penalties every year. The Internal Revenue Service department reports that the average penalty paid for inaccurate or postponed filings is $845. Payroll errors should not be ignored because, although they may annoy your staff, data that contain omissions or inaccurate information raises red flags.

Furthermore, it is nearly impossible for a small business to stay up to date on the most recent modifications to state and federal tax laws.

Professional providers can handle calculations and filings with the utmost ease and minimal cost because they are required to stay up to date with all federal and state regulations constantly.

- Can Multitask

In the modern business world, one person can wear several hats. But human error can still happen leading to mistakes such as giving workers the wrong paychecks. Do you feel at ease taking this chance?

Payroll processing takes a substantial amount of time to complete. In a 2018 Deloitte survey, over 25% of participants said that the majority of their payroll employees’ time is spent handling payroll.

Using an outsourced payroll provider can help increase productivity and streamline procedures, allowing members of the finance, payroll, and/or HR teams to concentrate on other tasks.

4. Acquire Access to Technology

Limitations in technology are a major cause of outsourcing by businesses. Can you provide employees with direct deposit? Do your workers have online access to their W-2s, tax records, and pay history? Strong technology and cloud-based tools are used by third-party payroll providers to give employees simple access to their data. Additionally, the majority of these tools enable accounting system integrations.

The most time-consuming part of processing each payroll is manually entering or loading inputs. Data entry can be made easier and processing times can be reduced by implementing software that automates manual tasks.

Additional features like applicant tracking, time and attendance tracking, benefit enrollment, etc., are provided by certain payroll companies.

5. Reduced Stress

Payroll processing is a stressful task. The livelihoods of people are in your hands. When you work with a third party, their professionals handle the headache and stress of the payroll process. But remember that your payroll duties don’t completely disappear if you outsource. Although the administrative and transactional aspects of payroll administration can be reduced through outsourcing, policy and decision-making still require in-house payroll specialists.

In addition, you will have to oversee the contract and keep your vendor updated on employee information. It’s still a big burden off your shoulders, though.

5 Factors to Consider When Outsourcing Payroll Services

These are the factors that you should pay attention to when outsourcing payroll services:

- Countries served

- Standardization in payroll processes and data

- Local expertise for airtight compliance

- HRIS or HCM integration

- Reporting and information security

Conclusion

Payroll outsourcing has its advantages but no company can point a company toward success with payroll management. However, a solid understanding of the pros and cons of payroll outsourcing can prove to be quite beneficial for your business. Hence, entrusting payroll processing to a specialized outsourcing partner like BOSS not only streamlines operations but also ensures adherence to regulations and minimizes the risk of errors and penalties. With benefits such as time savings, access to advanced technology, and reduced stress, outsourcing payroll services becomes a strategic move for businesses aiming to enhance efficiency.